2024 Global Business Travel: Projections and Perspectives

(09-28-2023)

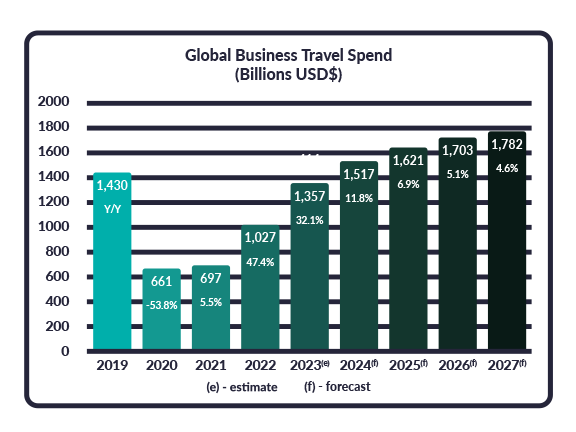

The Global Business Travel Association released its predictions with an exciting projection for 2024 of surpassing the global pre-pandemic business level spend to $1.4 trillion. This forecast further extends growth to $1.8 trillion by 2027.

Business travel spend and booking patterns are entering a dynamic environment. The pandemic’s overall influence on the direction of business travel is less important than other drivers including macroeconomic volatility, sustainability initiatives among stakeholders throughout the business travel ecosystem and shifts in workplace trends.

THE GLOBAL PERSPECTIVE

The impacts of inflation alongside consumer demand will determine the level of flattening of prices for corporate trips as it potentially fills the gap for the previous explosion of leisure bookings. Accordingly, suppliers will continue to have leverage as they manage their content/availability through dynamic pricing, with fewer reductions as they retain their pricing power.

GLOBAL ECONOMY AND THE IMPACT TO BUSINESS TRAVEL:

- The deceleration of global economic growth (expected to be just 3% over the next five years) will slow down price increases for business travel.

- Energy prices including fuel (both standard aviation kerosene and sustainable available fuel/SAF), as well as supplier energy costs are rising which will impact overall fare fluctuations.

NORTH AMERICAN PRICE PREDICTIONS

AIR:

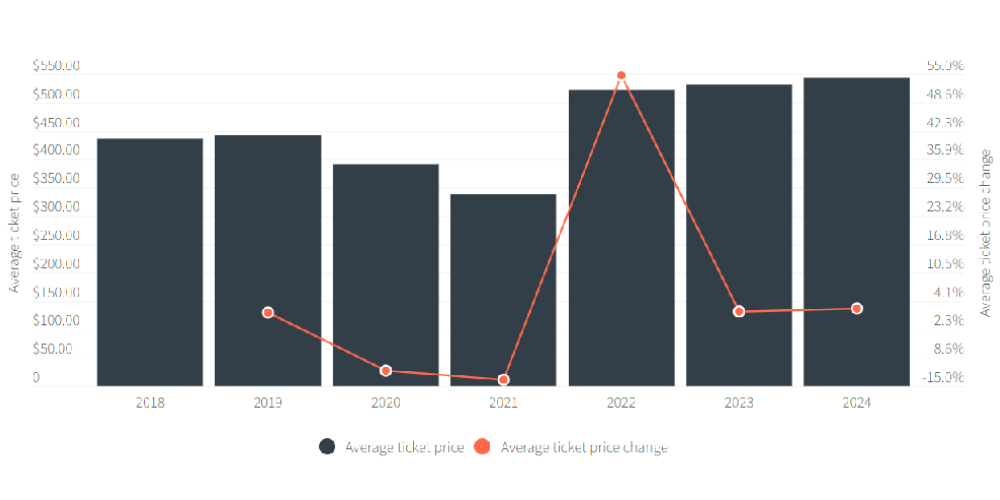

Economy Class fares are expected to rise 2.4% with an average fare of $614 (compared to 2023 average ticket price of $599).

MIDSCALE HOTEL:

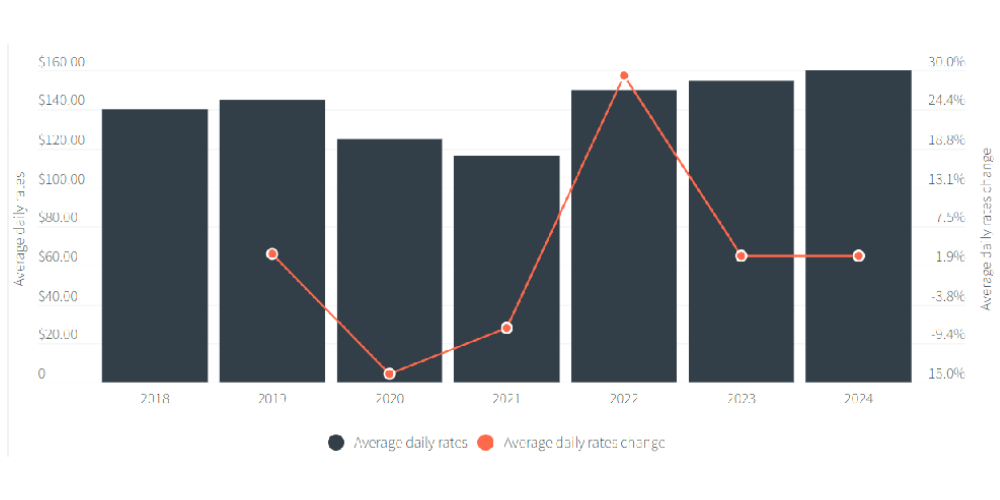

Midscale Hotel average daily rate change is forecasted to increase by 3.2% to $160 per room night with a 3.3% increase in upscale properties to $247 per room night.

SHIFTS IN CORPORATE FOCUS

- Carbon budgeting and the counting of emissions is gaining traction with more progressive companies signing up to Scope 3 emission cuts and science

based targets. This will drive the demand for sustainable aviation fuel, and purposeful travel buying decisions. - The cost of premium classes of service and upscale hotels are rising at the highest rate due to ongoing leisure travel demand. If this trend continues,

it is projected to shift policy parameters to accommodate for a premiumization of corporate travel and related budget alterations.

NEW TRENDS IN TRAVELER’S BUYING DECISIONS

- 82% of travelers reported that business travel is very or moderately worthwhile in achieving their business objectives.

- Rise in blending business and leisure travel. While this was a trending behavior in 2019, today’s business travelers are taking advantage of their

destinations to explore and build in a wellness perspective, especially on international travel.

The findings outlined above are the central findings from the latest Annual Global Report and Forecast published by GBTA.

Leave a Reply

Want to join the discussion?Feel free to contribute!