Modernizing Your Hotel Sourcing Strategy

Hotel Sourcing is taking on an entirely new approach as we work to understand your travelers’ needs alongside the fluctuation of rates within the industry.

1. Go Local

Not all companies can effectively achieve a brand-wide discount program. In fact, the most successful hotel sourcing programs are unique to each company with property locations near your headquarters or near your top client’s offices.

- Last Room Availability: If your locations are in smaller towns or communities where you have limited options for preferred hotels, consider a compromise on your discount rate by securing last room availability. The lowest discount will be of little value to your travelers if they are not able to secure a room when they need it.

- Loading in the GDS: A key component to a successful hotel program is the savings from online booking where a hotel is booked at the same time as the air reservation. This hotel ‘attachment’ not only highlights your preferred properties to encourage your travelers to select the property, but strengthens your duty of care program. When confirming your new rate, make sure they agree to load the rate in your GDS (Global Distribution System). Simple instructions can be sent to the property, and if you wish, TI can audit to ensure the rate was loading correctly.

2. Current Booking Data

It is time to look forward. While 2019 data may be a good baseline, your current booking data is what matters to each property. Most hotels will require a minimum of 150 room nights per year. While it is often tempting to include a wide range of hotels in your program, TI recommends to reduce your considerations for RFP to those properties that are your traveler’s favorite locations.

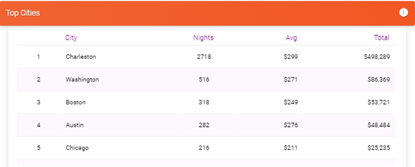

- Top Properties by Location: Whether the property was previously preferred or not, review your top cities first to identify how many properties are being booked in each location as well as how many room nights per property.

- Consolidate: When reviewing your data and the number of properties for each location, consider reducing and diversifying these to two or three per location depending on the size and the number of room nights. You will want to include the most favorable properties for the RFP which can then be consolidated down once the RFP responses are received which will include their current amenities, housekeeping status, restaurant hours and of course price.

3. Benchmark

Once you have your properties identified and RFP Responses received, it is time to benchmark the rates. Rate types can include dynamic, which is a percentage off the room rate and fluctuates according to seasonality, or a static rate which is a fixed price for any time of year. Hotels in larger cities such as New York City, Boston, San Francisco or Chicago prefer to offer a percentage discount whereby more regional properties are happy to average the rate to a fixed price.

- BTN Corporate Travel Index is an annual publication which outlines average hotel and car rental rates for the top 200 cities, including per diems and percentage increase/decrease of the rates by city.

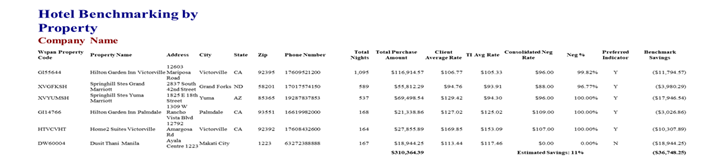

- Travel Incorporated Hotel Benchmarking Report is available in your Evolution reporting. This valuable report provides the average price per property, including negotiated rates, which is determined by our extensive client base.

4. Your Traveler’s Voice

Your hotel sourcing strategy will not yield the results intended unless your travelers book the preferred properties. While many components go into the traveler decision making process, it is important that you request their input, identify trends in amenities preferences, evaluate their requests, and then communicate back to them how their feedback was taken into consideration. Travelers appreciate authenticity and transparency in company communications, accepting a logical reason for decisions that were made on their behalf.

- Survey Your Top Travelers: It is not always realistic to survey every profiled employee, as some are occasional travelers, while others are on the road much more frequently. Surveying your top travelers will ensure the majority of your hotel spend is considered, while demonstrating the importance of their voice to your overall travel program. Make sure you know what is most important to them, including their personal loyalty towards given brands.

- Encourage Booking Hotels via your Online Booking Tool: Utilizing your online booking tool for hotels is not only a cost savings initiative, it directly impacts your ability to ensure a successful Duty of Care program. As we all have experienced, the importance of traveler safety and monitoring has become invaluable. Consider adding a “message” to your online booking path reminding your travelers to book their hotel at the time of their air reservation.

Summary

Today’s corporate hotel program requires flexibility and more frequent reviews. Hotels are not auto-renewing contracts unless the committed room nights are being booked. Travel Managers should be reviewing their spend, adoption, and compliance monthly to ensure their partnerships are delivering the amenities your travelers expect, and you are in turn strengthening your relationship with each unique property. When evaluating the success of your program, benchmarking domestically 10% of the properties used by your travelers should represent 65% of your total hotel spend.

Consider utilizing Travel Incorporated’s Hotel RFP Service – professional help with a measurable return on investment.

Leave a Reply

Want to join the discussion?Feel free to contribute!