2024

Travel Market

Report

Travel Incorporated has taken the input of various sources including The Economist, air passenger market analysis from IATA, the OAG (Official Airline Guide) and BCD, our global servicing partner, to combine and summarize the most significant trends that are likely to impact business travel.

Politics, Geopolitics and Economics

From the political and geopolitical viewpoint, the U.S. presidential election will have global impact ranging from climate policy to support of the Ukraine. The Middle East, Israel and Gaza disruption along with the instability in Africa’s Sahel is causing distraction from the U.S. and its unipolar focus on countering China in Asia.

The economic uncertainty is largely driven by technology, the energy sector and interest rates. Starting with AI (artificial Intelligence), with increased adoption, the market is closely watching the impact of job losses. The energy sector is forming new superpowers to replace oil with copper, lithium and nickel. Interest rates are staying higher for longer, impacting momentum in Western economies, but do expect the rates to start to be reduced by mid-2024.

Top Business Trends

• Renewable energy consumption climbs, including growth in electric vehicles

• Further virtual workforce, as 60% of firms in the U.S. allow remote working

• Healthcare spending expands to 10% of the GDP (global domestic product) due to a similar percentage

• Record travel revenue for international tourism outpacing geopolitical and economic uncertainty

Domestic airliner traffic achieved its recovery in April 2023. While other regions have made more progress in their recoveries, only Latin America and North America have so far managed to sustain air travel demand above pre-pandemic levels.

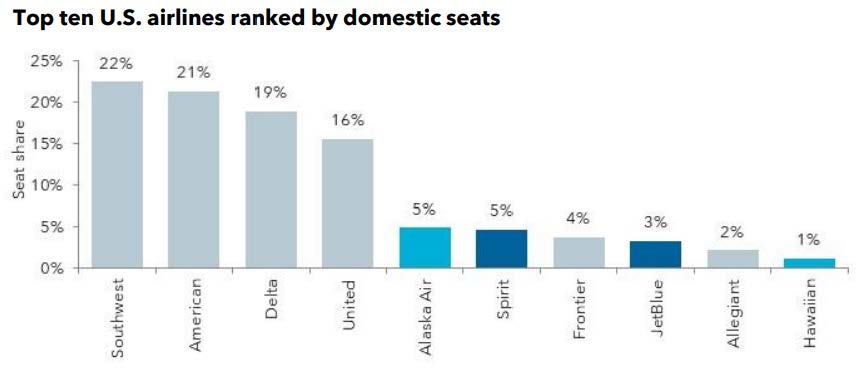

United States: Ten airlines account for 98% of seat capacity. The JetBlue acquisition of Spirit Airlines was in doubt and discussions terminated. This merger would have created the fifth-largest U.S. airline.

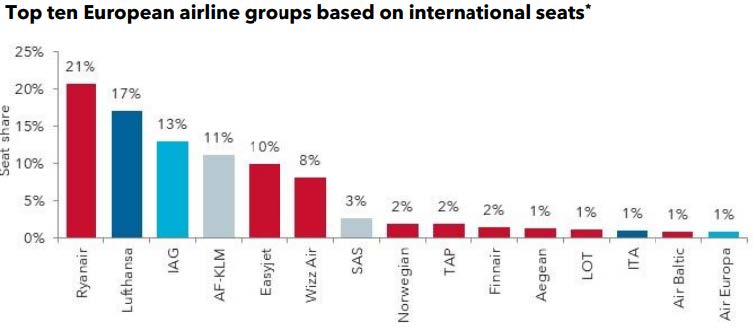

Europe: Second tier full-service airlines are the subject of a new round in consolidation.

• Air-France/KLM is investing in SAS, forcing the Scandinavian airline out of the Star Alliance and into SkyTeam

• IAG is buying Air Europa, cementing its position in the Spanish market

• Lufthansa Group has agreed to buy ITA Airways, Alitalia’s successor

• TAP Air Portugal is due to be privatized

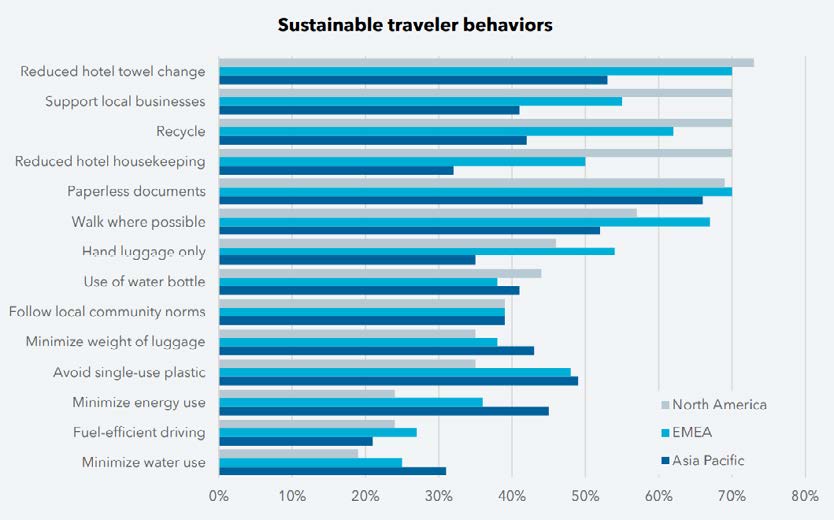

In a recent survey of 100 travel buyers and over 1800 travelers in each region of the world, sustainability has become an essential consideration for all aspects of doing business, however, while 82% of companies have sustainability goals in place, just 45% include targets for sustainable business travel.

Survey responses suggest that travelers’ lack of knowledge about their company’s sustainability agenda is the consequence of poor communication from both executive levels as well as travel departments with only 20% of business travelers stating they were aware of their company’s sustainability travel goals.

When it comes to awareness of the topic, North American travelers trail those in EMEA and Asia Pacific. This is often a result of a broader country specific approach and guidance by governmental agencies which impact supplier and user perspectives.

Travel Market

Report