Projecting Costs: BTN Corporate Travel Index

(March 2022)

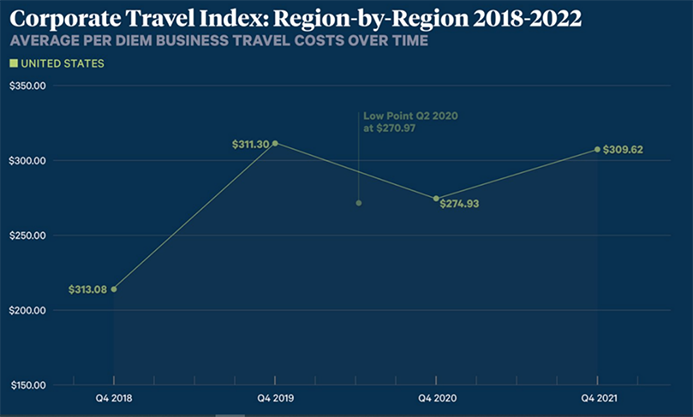

Projecting costs and managing budgets in post-pandemic periods is challenging. However, with the analysis from the BTN (Business Travel News) Corporate Travel Index, much of the guess work can be reduced by understanding the shifts related to the average daily costs of travel for hotel and ground transportation. Whether you look at the costs being on the rise as a good barometer of the health of renewed business travel, or choose to view the costs rising faster than the corporate travel recovery, the fact is that it is time to review your top cities and prepare for the outcome. For your convenience, we have provided a link to the Corporate Travel Index Calculator, which allows you to search by city, hotel tier, car rental class and meals for the United States as well as non U.S. major cities.

Key Points for your Attention

Covid-19 and its related variants will not exit the corporate travel stage in 2022. The most recent Omicron variant BA.2 is just another example that the way forward will not be like the way before it. Disruption will occur and service levels will continue to be volatile as a result of the industry responding beyond predictions and estimates.

Image Source: BTN

Hotels

With pent up demand for travel, hoteliers are seeing unique trends including:

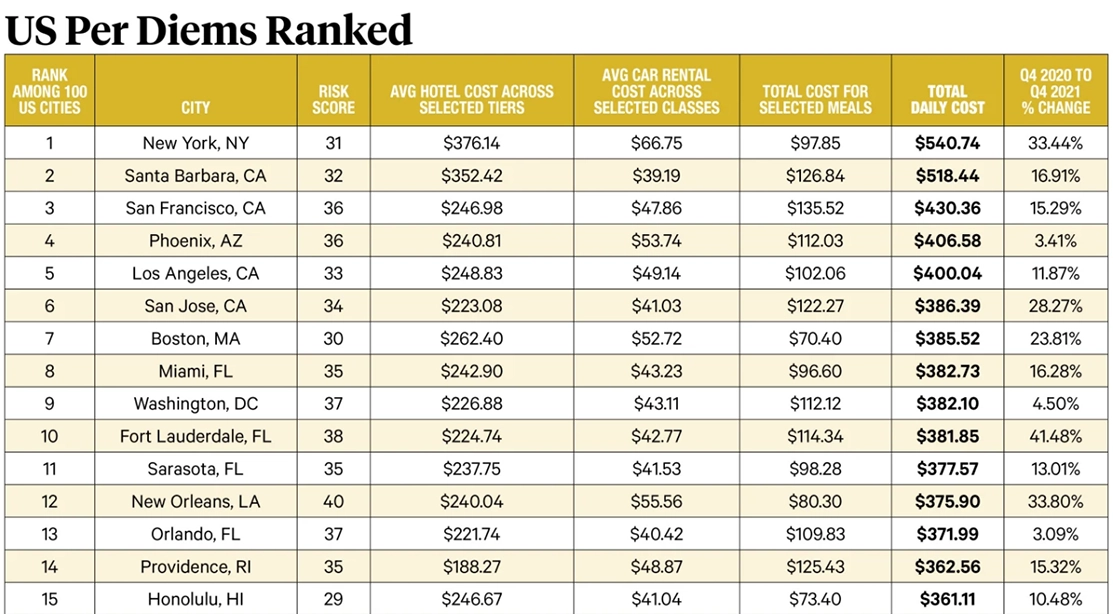

- Outside Major Gateway Cities: Many travelers are exploring business outside the larger gateway cities. Secondary cities like Cleveland and Columbus Ohio, Indianapolis, Louisville, KY and Tulsa Oklahoma have each seen double digit hotel rate percentage increases.

- Primary cities are strongly divided: Cities including New York, Chicago, Philadelphia, Seattle and Washington DC are lagging 2019 price points, averaging rates from 7-10% lower than 2019 levels. Contrary to these markets, hotels in Miami are up 23%, Los Angeles nearly 16% and Dallas up more than 6%.

- Cities known for dot-coms: Cities such as San Francisco which is averaging a 35% decline of 2019 rates, is largely thought to be due to most companies have not returned to the office, and related demand for properties for visiting partnerships are remaining virtual for the time being.

Ground Transportation

- Slight drop in top 100 cities: Although much has been said about car availability at airport rental car locations, the rate of the rental has stabilized, dropping slightly from the escalated 2020-2021 period.

- Stand firm with negotiations: The rental car markets are competitive and your preferred supplier does not want to lose your business. Review both your TMC and Expense data to identify your total spend for rental car, review with the corporate travel index and then hold firm with your requirements.

Image Source: BTN

Leave a Reply

Want to join the discussion?Feel free to contribute!